By Mati Ullah Khan

Since Pakistan Democratic Movement (PDM) led by Pakistan Muslim League-Nawaz (PML-N) voted out the Pakistan Tehreek-e-Insaf (PTI) government in April 2022 and took over the reign of the Country, a narrative has consistently been propagated that it was former Prime Minister Imran Khan who pushed the County into the quagmire of economic turmoil.

Let’s dig into the facts and review the economic statistics to ascertain whether it’s been a mere political rhetoric of the incumbent government to malign its predecessor and use it as a scapegoat or PTI undoubtedly left the economy in a depleting state.

Foreign Exchange Reserves:

Foreign Exchange Reserves:

By March 2022 end – 10 days before PTI’s rule was over –, the Net Reserves held with the State Bank of Pakistan (SBP) were US$ 11.42 billion while the Country’s total Liquid Foreign Exchange Reserves stood at US$ 17.42 billion. In fact, these were more than what PML-N had left when they completed their five-year tenure on May 31, 2018. By May 2018 end, the SBP had net reserves of US$ 9.51 billion whereas in total, they were US$ 15.09 billion.

It’s also worth noting that the Liquid Foreign Exchange Reserves stood at US$ 22.63 billion including US$ 16.38 billion with the SBP as of February 2022 end, just a week before the Vote of No-Confidence was tabled in the National Assembly to oust Prime Minister Imran Khan.

Also Read: Economic Performance of PPP, PML-N & PTI since 2008

Unlike PTI or even PPP, PML-N didn’t suffer at all from the external front in their five-year tenure (2013-18) as the world remained oblivious of COVID-liked pandemic and its economic repercussions by that time and in fact the global commodity prices were at low level.

Whereas in PTI’s tenure, COVID-19-triggered global economic slowdown, health-related soaring imports i.e., vaccines, Personal Protective Equipments (PPEs), and medicines etc, COVID-related foreign aid, and later elevated global commodity prices caused by post-COVID scenario and Russia-Ukraine Conflict put additional pressure on foreign reserves in an import-driven economy.

Additionally, PML-N received US$ 49.762 billion as foreign loans and repaid US$ 27.071 billion as debt servicing – less than PTI’s reimbursement of loans. Yet the Country’s Foreign Exchange Reserves kept on depleting and shrunk to only US$ 9.51 billion in 2018.

The PML-N’s staunch supporters believe that it was China Pakistan Economic Corridor (CPEC) which led to a surge in imports i.e., machinery imports. In fact, CPEC is an ongoing project and under which, not only road infrastructure and energy power projects continued in the PTI government but rather they also initiated the work on Special Economic Zones (SEZs), New Gwadar International Airport, the Gwadar Free Zone (GFZ) (Phase II), and several dams including two major ones — Mohmand and Diamer-Bhasha Dams. Hence, CPEC-led imports and foreign inflows didn’t cease to materialize even after PML-N’s tenure.

If the PML-N’s assertion of being forced to run the Country’s affairs in April 2022 to ward off the imminent default is yet be given a weightage, after 10 months of their arrival, the net reserves held by the Central Bank had dipped to a critical low level of US$ 2.91 billion as of February 03, 2023, registering a decrease of 74.51% from where PTI had left.

Inflation in first FY of PML-N, PTI, and PDM:

Party | Fiscal Year | CPI Inflation Rate |

| PML-N | FY 2013-14 | 8.6% |

| PTI | FY 2018-19 | 6.8% |

| PDM | FY 2022-23 | 29.18% |

Also Read: Inflation in PML-N governments

Also Read: Inflation in PPP governments

Trade Deficit & CAD:

The Country’s Trade Deficit and Current Account Deficit (CAD) rose to US$ 39.6 billion and US$ 17.4 billion respectively by the end of Fiscal Year (FY) 2021-22 (June 30) – (Note: by March 2022 end, Trade Deficit was US$ 30.1 billion and CAD was US$ 13.2 billion). Inarguably, the mounting figures disturbed the balance of payment, resulting in the depletion of foreign reserves and bringing the exchange rate under pressure.

The PML-N leaders and their loyalists argue that US$ 39.6 billion Trade Deficit was enough to bankrupt the Country and pinned blame on PTI for it. Though in the above part, it has been explained as what led to the sharp economic deterioration but it also needs to be reminded that how PML-N had treated the economy in terms of Trade Deficit and CAD in 2017-18.

In FY 2013, Pakistan People’s Party (PPP) left a Trade Deficit of US$ 20.4 billion and US$ 2.5 billion as the Current Account Deficit but when PML-N completed its full tenure in 2018, the figures had mounted to US$ 37.5 billion and US$ 19.1 billion respectively.

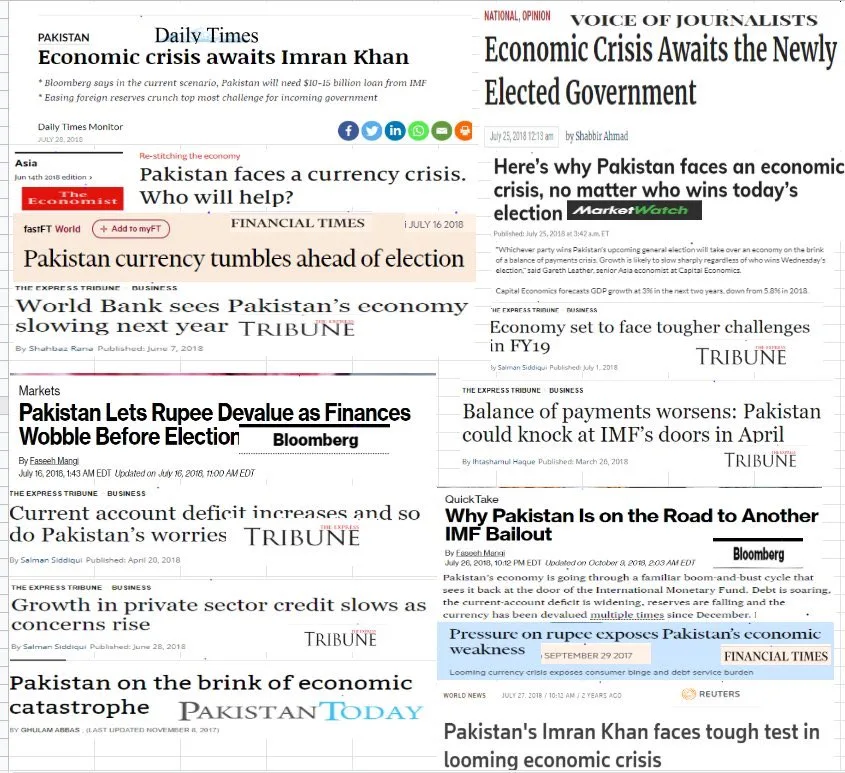

Foreign & Local Media lamenting the weak state of Pakistan’s economy in 2018;

From 2018 to 2022, PTI increased the exports to US$ 32.5 billion from US$ 24.8 billion and remittances to US$ 31.2 billion from US$ 19.9 billion. Whereas, exports in PML-N’s five-year tenure posted a negative growth and they failed to surpass the exports figures of what PPP had left in 2013. Likewise remittances in last three years of PML-N remained stagnant at US$ 19.9 billion.

From 2018 to 2022, PTI increased the exports to US$ 32.5 billion from US$ 24.8 billion and remittances to US$ 31.2 billion from US$ 19.9 billion. Whereas, exports in PML-N’s five-year tenure posted a negative growth and they failed to surpass the exports figures of what PPP had left in 2013. Likewise remittances in last three years of PML-N remained stagnant at US$ 19.9 billion.

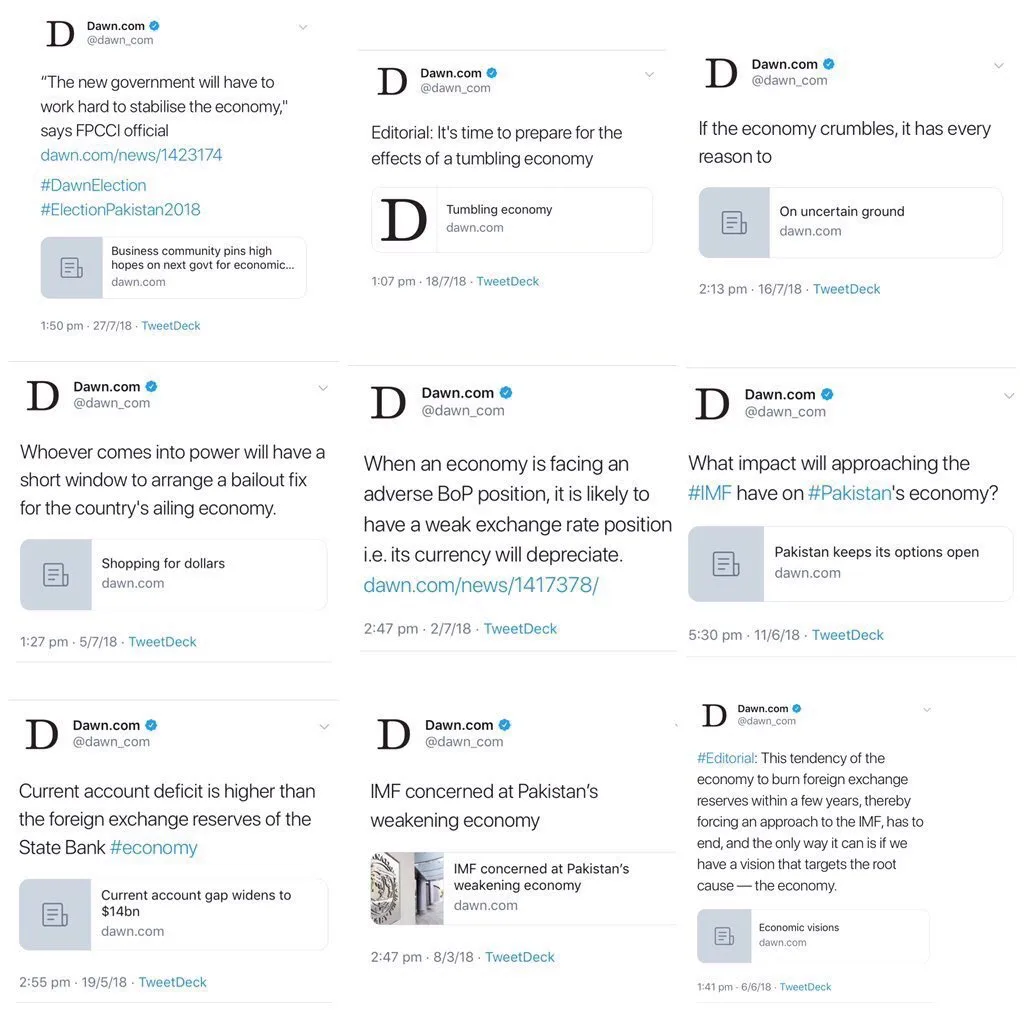

Dawn cautioning about looming economic crises in Pakistan in 2018;

With regards to imports, PTI took them to US$ 72.2 billion from US$ 55.7 billion against the US$ 40.2 billion to US$ 55.7 billion imports of PML-N.

Certainly, PML-N performed slightly better in terms of Foreign Direct Investment (FDI) and PTI’s FDI figures were not up to the mark. However, multiple determinants can be attributed to a decline in foreign direct investment in the PTI government. Unfortunately, the foreign investors couldn’t find a conducive environment in Pakistan in recent years to flourish their businesses. Since 2019, Pakistan has vigorously been engaged on multiple fronts i.e., heightened tensions with India over Kashmir issue and February 27, 2019 dogfight, suspension of Pak-India trade, COVID-19 impacts, attack of crop-eating locust, FATF, reemergence of Afghan Taliban in Kabul, and security and political instability; thus, gloomy conditions for foreign investors to have apprehensions about Pakistan.

4 years of PTI vs 5 years of PML-N: Comparison

Party | Exports ($ billion) | Imports ($ billion) | Remittances ($ billion) | Trade Deficit ($ billion) | CAD ($ billion) |

| Increase + / Decrease – | |||||

| PML-N (2013 – 18) | 24.8 – 24.8 (0%) | 40.2 – 55.7 (+38.55%) | 13.9 – 19.9 (+43.16) | 20.4 – 37.5 (+83.82%) | 2.5 – 19.1 (+664%) |

| PTI (2018 – 22) | 24.8 – 32.5 (+31.04%) | 55.7 – 72.2 (+29.62%) | 19.9 – 31.2 (+56.78) | 37.5 – 39.6 (+5.6%) | 19.1 – 17.4 (-8.90%) |

IMF Standoff:

Another narrative which PML-N leadership heavily relies upon, accusing PTI of sabotaging the International Monetary Fund (IMF) program by violating the agreement the government had inked with the lending body in February 2022.

In February 2022, the IMF The Executive Board completed the Sixth Review under the Extended Fund Facility (EFF) for Pakistan, allowing the authorities to lend about US$ 1 billion to the South Asian Country.

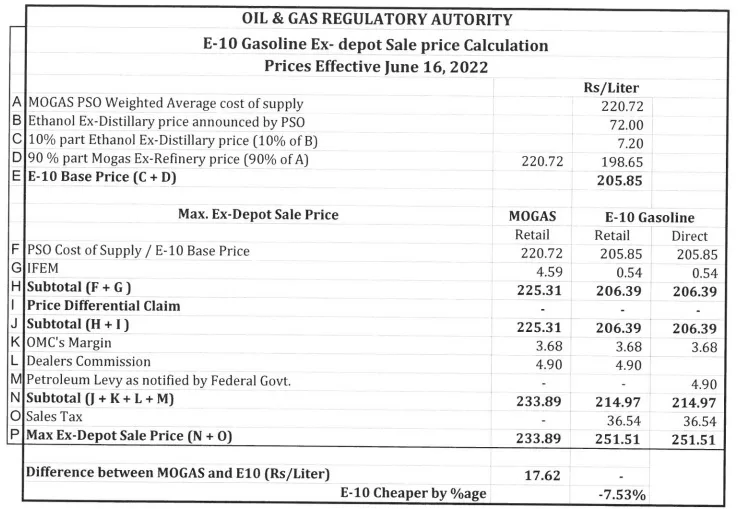

Under the understanding reached with IMF, the Pakistani government had to increase the Petroleum Development Levy (PDL) by Rs 4 per liter per month until a maximum of Rs 30 per liter was achieved.

However, in a televised address to the nation on February 28, 2022, the then Prime Minister Imran Khan announced to slash petroleum prices by Rs 10 per liter with immediate effect as well as Rs 5 per unit relief for low & middle income electricity consumers.

The announcement though was a massive relief for inflation-stricken people; however, it didn’t go well in quarters of then opposition PDM alliance. They termed it a ‘political stunt’ and alleged that the relief was tantamount to breaching the agreement with the IMF and aimed at ‘planting mines’ for the upcoming ruling setup, knowing that a Vote of No-Confidence was around the corner and Imran Khan had just a few days to stay in power. Ironically, it was the same opposition which earlier used to slam the PTI government for ‘selling the Country to IMF’ and ‘turning people’s lives into hell’ by fulfilling the agenda of the global financial body.

To materialize the relief announcement, the PTI government reduced the levy to 0 from Rs 17.92 imposed on February 16, 2022.

Interestingly, the PDM government – which had earlier slammed PTI for not abiding by the IMF agreement of gradually raising the PDL to Rs 30 – itself kept the Petroleum Levy and General Sales Tax (GST) at zero till June 30, 2022 and continued to provide subsidy to the consumers. Whereas the GST on petroleum products continues to remain zero even as of now.

In the opposition, the PDM never accepted the IMF agreement inked by the PTI government and rather described it as a ‘suicidal’ one. The IMF EFF programme of July 2019 was to end in September 2022; however, later the PDM government extended the same EFF arrangement through June 2023.

In fact, they completed the Seventh and Eighth Reviews under the IMF EFF in September 2022 and agreed to increase petroleum levy from Rs 30 up to Rs 50 per liter on RON 95 and above.

In late September 2022, Senator Ishaq Dar assumed the Office of the Ministry of Finance and Revenue and he slashed the petroleum prices bypassing the agreed measures settled with the IMF, a replica of what the PTI government did in March 2022. The new finance minister also allegedly attempted to influence the exchange rate, another blow to the deal with the IMF which insists on a market-driven exchange rate.

Eventually, the talks with IMF met an impasse and rather Ishaq Dar began uttering startling statements on media i.e., IMF is ‘behaving abnormal’, ‘I don’t care about IMF’s dictation’, ‘I know how to deal with IMF’, and ‘we don’t care if IMF doesn’t lend money, we will manage from somewhere else’. However later, the finance minister bowed down to all demands of IMF; though, the staff-level agreement for the ninth review hasn’t been finalized yet.

Fitch Downgrades Pakistan’s Ratings:

On February 14, 2023, after over 10 months since the ‘experienced’ PDM took over the government – the global rating agency Fitch downgraded Pakistan’s Long-Term Foreign-Currency Issuer Default Rating (IDR) ‘CCC-’ from ‘CCC+’, saying that it was a reflective of further sharp deterioration in liquidity and the decline of the Country’s foreign exchange reserves to critically low levels.

Moody’s Downgrades Pakistan’s Ratings:

On February 28, 2023, the Moody’s Investors Service (“Moody’s“) also downgraded Pakistan’s local and foreign currency credit ratings to Caa3 from Caa1 in the wake of the drop in the foreign exchange reserves and rise in risk of default on foreign debt repayment.

It’s worth noting that even in June 2018 a few weeks after PML-N left the government, Moody’s downgraded the outlook on Pakistan’s rating to negative from stable due to its heightened external vulnerability risk.

Though later in December 2019, the agency upgraded Pakistan’s credit rating outlook to ‘stable’ from ‘negative’.

Pakistan’s Credit Default Swap:

Pakistan’s risk of default – measured by the 5-year Credit Default Swap (CDS) – was merely 5% in March 2023; though later spiked to 92.53%, according to data by Arif Habib Limited (AHL).

Pakistan 5-Year CDS sharply rose by 1,929bps to 7,550bps by DoD. @GovtofPakistan @FinMinistryPak#Pakistan #Economy #AHL pic.twitter.com/HTwV0luG4c

— Arif Habib Limited (@ArifHabibLtd) November 16, 2022