For online payment of Sales Tax, Federal Excise Duty (FED) and Income Tax Refunds, all Taxpayers must follow the four steps process after login to Iris to modify or add a new bank account with International Bank Account Number (IBAN) as explained in the below images.

Steps to modify/add a new bank account with IBAN:

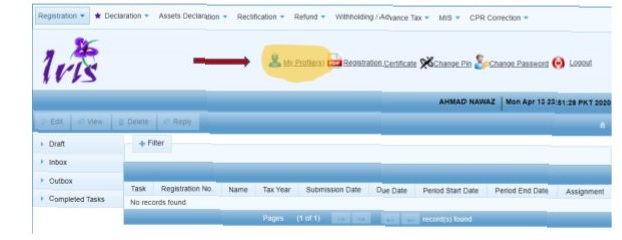

Step 1: Logon to Iris https://iris.fbr.gov.pk/public/txplogin.xhtml

Step 2: From Iris dashboard, Click on “My Profile” (highlighted in the below image):

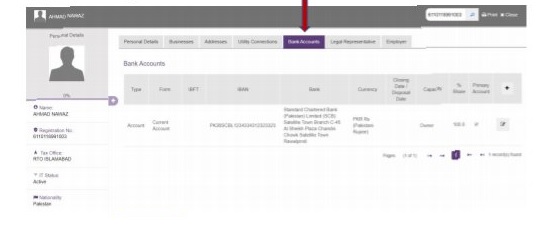

Step 3: In case of taxpayer, the system will load the current registration profile as given below.

Intermediaries shall provide CNIC for Pakistani Individual and NTN for AOP/Company/Foreign Individual and click on the search button to load respective taxpayer data.

Step 4: Click on “Bank Accounts” tab as highlighted above, the system will show you already added bank accounts (if any). Either click on “Edit” icon to select and modify your existing account or click on “+” icon to add a new account.

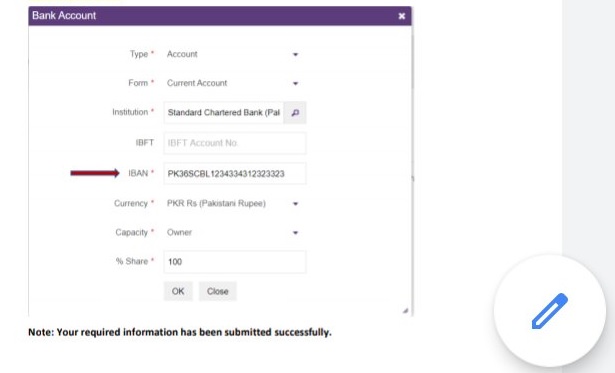

Provide required information including 24 digit IBAN number which is mandatory and click on “OK” Button.

Source: FBR