Check out new National Savings Profit Rates since the incumbent government has reduced the profit margins of various Saving Schemes for the third time in the ongoing year – 2020.

The National Savings on June 2 revised the profit rates of its Schemes– slashing the profit rates by 48-90 basis points on them.

National Savings Schemes Profit Rates revised for the third time in 2020

Previously, the profits rates on various National Savings Schemes were revised on January 1 and April 24, 2020.

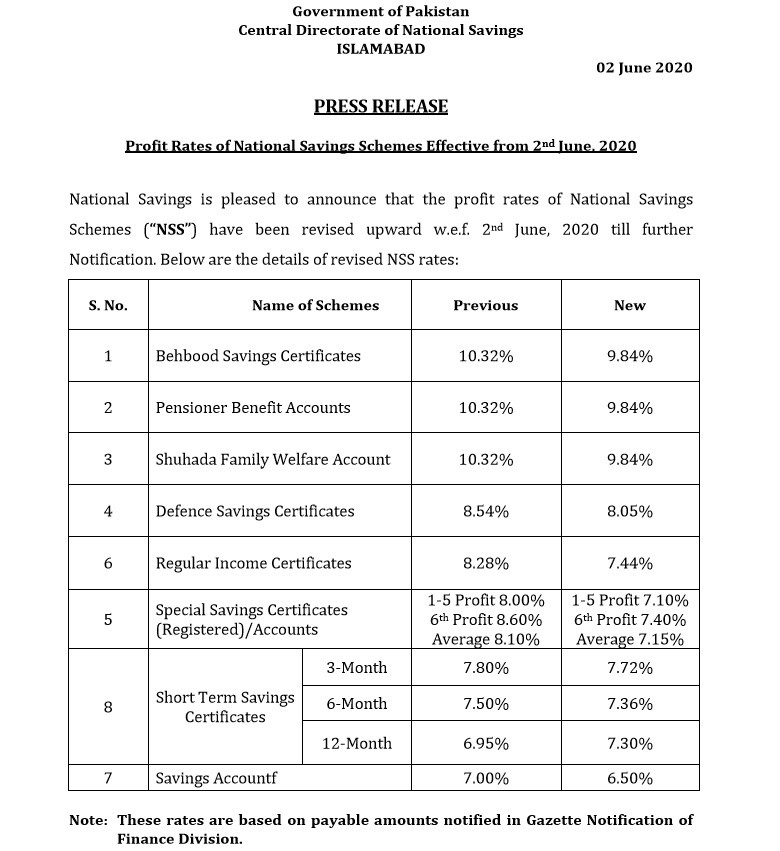

The government has reduced the profit rate on Defense Saving Certificates (DSC) by 49 basis points to 8.05%, on Regular Income Certificates (RIC) by 84 basis points to 7.44%, on Special Savings Certificates (SSC) by 90 basis points to 7.10%, on Bahbood Savings Certificates (BSC), Pensioner Benefit Accounts (PBA) & Shuhada Family Welfare Account (SFWA) by 48 basis points each to 9.84%, and on Saving Accounts by 50 basis points to 6.50%.

Earlier the profit rate on DSC was cut to 10.40% on January 1, 2020 and then 8.54% on April 24, 2020; the profit rate on RIC was cut to 10.56% on January 1, 2020 and then 8.28% on April 24, 2020, and the profit rate on SSC was cut to 8.00% on April 24, 2020.

Likewise, previously the profit rates of BSC, SFWA & PBA fixed at 10.32% each.

It’s worth noting the financial institution operates as an autonomous body under the Ministry of Finance and is managed by the Central Directorate of National Savings (CDNS).

As a custodian of the nation’s savings, today it is the largest investment and financial institution in Pakistan with a portfolio of over Rs 3.4 trillion and more than 7 million valued investors are being served through a large network of 376 branches nationwide controlled by 12 Regional Directorates of National Savings (RDNS) and 4 Zones.