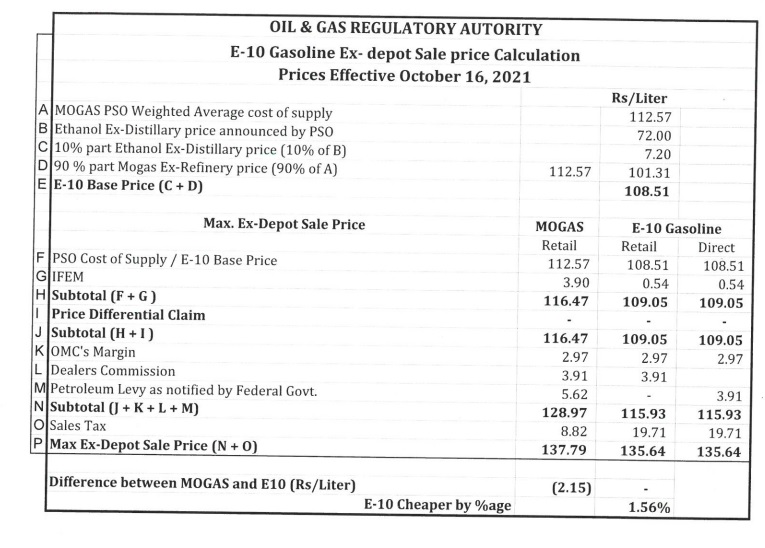

In the wake of a sharp surge in the petrol price in the international market, the federal government on October 16 increased the petrol price by Rs 10.49 per litre for the next fortnight, and now the petrol price in the Country has reached Rs 137.79 per litre.

To provide maximum relief to the consumers, the government absorbed the pressure and kept Petroleum Levy and Sales Tax to the minimum.

Petrol (Brent Crude Oil) Price in International Market

- One year ago: US$ 43 per barrel

- Six months ago: US$ 66 per barrel

- Three months ago: US$ 73 per barrel

- One month ago: US$ 75 per barrel

Now: US$ 85 per barrel

- Pakistan buys Brent Crude Oil from the OPEC Market, and which price has now hit US$ 85 per barrel, the highest since October 2018.

- In the last fortnight, the petrol price increased from 10 to 15% in the international market.

To be fair, the following prices are not in PTI’s control:

Oil from $37 to $84

Palm Oil up 36%

Coal from $60 to $250

LNG from $10 to $50— farrukh saleem (@SaleemFarrukh) October 12, 2021

Taxes on petrol in Pakistan

- For the next fortnight, Rs 14.44 is being charged in the form of taxes on petrol, which is 10% of the total petrol price (137.79 per litre).

- Petroleum Levy: Petroleum Levy can be imposed up to Rs 30 on per litre petrol; however, the government is charging Rs 5.62.

- Sales Tax: Sales Tax can be imposed up to Rs 17 on per litre petrol; however, the government is charging Rs 8.82.